When it comes to investing, dividend stocks are a popular choice among investors seeking consistent income and long-term wealth accumulation. 5starsstockscom has become a trusted platform for discovering top-performing dividend stocks. Whether you're a seasoned investor or just starting, uncovering the top dividend stocks on 5starsstockscom can provide valuable insights and opportunities for financial growth. Dividend stocks are known for their ability to provide regular payouts to shareholders, making them an attractive option for those looking to generate passive income. With the abundance of information available on 5starsstockscom, investors can make informed decisions and build a robust dividend portfolio.

In this article, we'll delve into the world of dividend stocks and explore the opportunities available on 5starsstockscom. By examining the key factors that contribute to a successful dividend investment strategy, readers can gain a deeper understanding of how to maximize returns. From identifying companies with a strong track record of dividend payments to analyzing potential risks, uncovering the top dividend stocks on 5starsstockscom can be a game-changer for any investor.

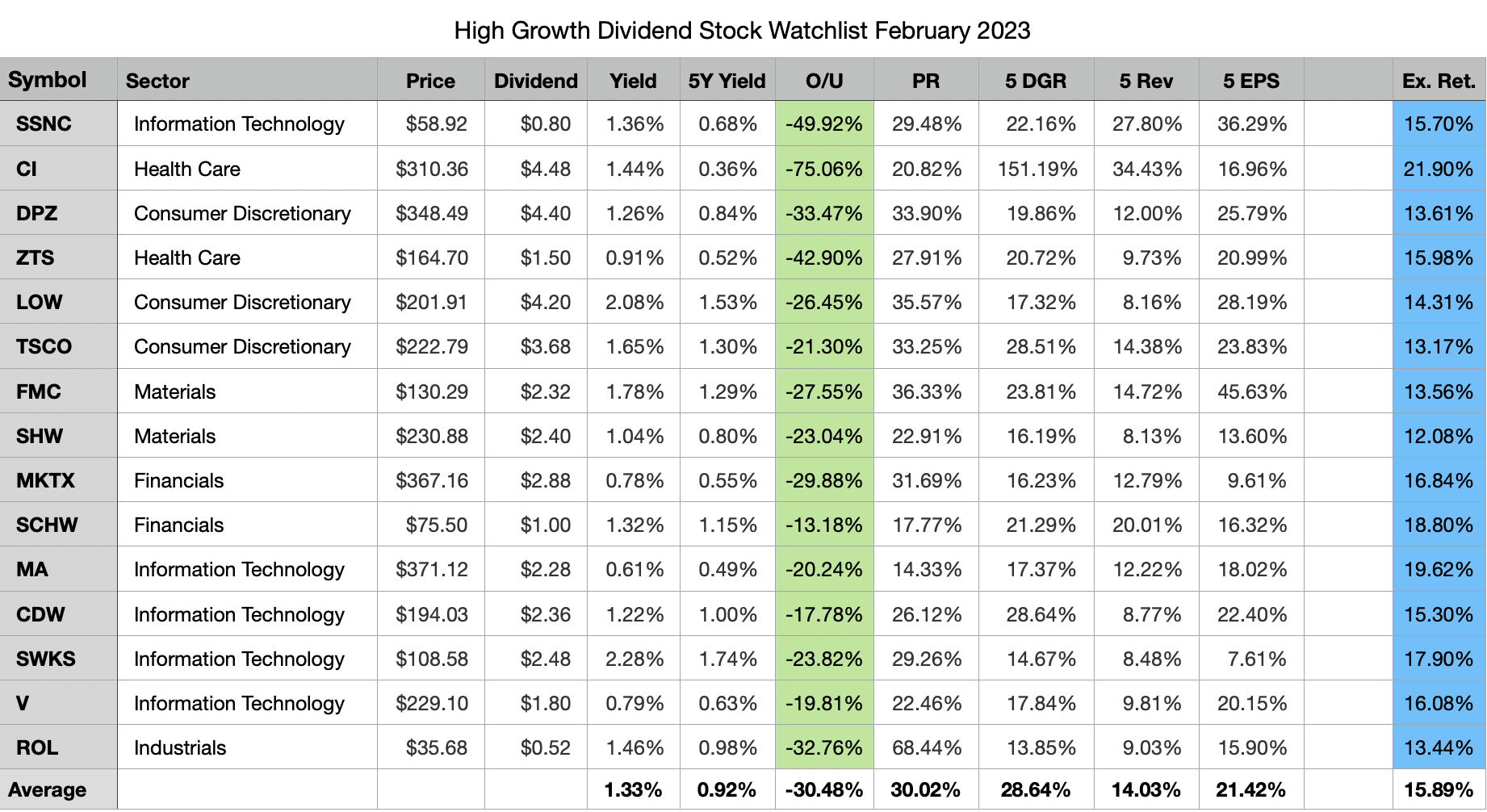

As we navigate through the various aspects of dividend investing, we'll also highlight some of the top-performing dividend stocks featured on 5starsstockscom. These stocks have been carefully selected based on factors such as dividend yield, payout ratio, and growth potential. By the end of this article, readers will have a comprehensive understanding of how to leverage 5starsstockscom to uncover the top dividend stocks and optimize their investment strategy.

Read also:Maynard Keenans Wealth A Rock Legends Financial Overview

Table of Contents

- What Are Dividend Stocks?

- Why Invest in Dividend Stocks?

- How Can 5starsstockscom Help Investors?

- What Factors Should Be Considered When Choosing Dividend Stocks?

- Uncover the Top Dividend Stocks on 5starsstockscom

- The Role of Dividend Yield in Investing

- Understanding Payout Ratios

- Growth Potential of Dividend Stocks

- How to Diversify a Dividend Portfolio?

- What Are the Risks Associated with Dividend Investing?

- Case Study: Successful Dividend Investments

- Tips for Beginners Investing in Dividend Stocks

- How to Use 5starsstockscom to Optimize Investments?

- Frequently Asked Questions About Dividend Stocks

- Conclusion: Unlocking Potential with Dividend Stocks

What Are Dividend Stocks?

Dividend stocks are shares of companies that regularly distribute a portion of their earnings to shareholders in the form of dividends. These payments are typically made on a quarterly basis and provide investors with a steady income stream. Companies that issue dividends are often well-established, financially stable, and have a history of profitability. By investing in dividend stocks, investors can benefit from both capital appreciation and income generation.

Why Invest in Dividend Stocks?

There are several compelling reasons to invest in dividend stocks:

- Consistent Income: Dividend stocks provide regular income to investors, which can be reinvested or used for other financial goals.

- Stability: Companies that pay dividends are often financially stable and have a proven track record of earnings.

- Potential for Growth: Dividend stocks can offer capital appreciation, allowing investors to benefit from both income and growth.

- Inflation Hedge: Dividend payments can help mitigate the impact of inflation on purchasing power.

How Can 5starsstockscom Help Investors?

5starsstockscom is a valuable resource for investors looking to uncover the top dividend stocks. The platform provides comprehensive analysis, expert insights, and up-to-date information on dividend stocks. By utilizing the tools and resources available on 5starsstockscom, investors can make informed decisions and optimize their dividend investment strategy.

What Factors Should Be Considered When Choosing Dividend Stocks?

When selecting dividend stocks, investors should consider the following factors:

- Dividend Yield: The annual dividend payment expressed as a percentage of the stock price.

- Payout Ratio: The proportion of earnings paid out as dividends.

- Company Stability: Financial health and stability of the company.

- Dividend Growth: Consistency and growth potential of dividend payments.

- Industry Trends: Economic and industry factors that may impact the company's performance.

Uncover the Top Dividend Stocks on 5starsstockscom

5starsstockscom features a range of top-performing dividend stocks that have been carefully selected based on various criteria. These stocks are known for their strong dividend yield, reliable payout history, and growth potential. By exploring the curated list of dividend stocks on 5starsstockscom, investors can uncover opportunities that align with their investment goals.

The Role of Dividend Yield in Investing

Dividend yield is a crucial metric for dividend investors, as it indicates the return on investment from dividend payments. A higher dividend yield can provide a more substantial income stream, but investors should also consider the sustainability and growth potential of the dividends.

Read also:Meet Lauren Daigles Husband A Love Story Unveiled

Understanding Payout Ratios

The payout ratio is an essential factor in evaluating the sustainability of a company's dividend payments. A lower payout ratio suggests that the company retains more earnings for reinvestment and growth, while a higher ratio may indicate limited reinvestment potential. Investors should assess payout ratios in conjunction with other financial metrics to determine the overall health of a company's dividend.

Growth Potential of Dividend Stocks

Dividend stocks with growth potential offer investors the opportunity to benefit from both income and capital appreciation. Companies with a history of increasing dividend payments demonstrate a commitment to rewarding shareholders and indicate strong financial performance. Identifying dividend stocks with growth potential is a key strategy for maximizing returns.

How to Diversify a Dividend Portfolio?

Diversification is a critical component of a successful dividend investment strategy. Investors should consider building a portfolio that includes a mix of dividend stocks from different industries and sectors. By diversifying their holdings, investors can mitigate risk and ensure a stable income stream, even if certain sectors experience volatility.

What Are the Risks Associated with Dividend Investing?

While dividend stocks offer many benefits, they also come with certain risks:

- Market Volatility: Stock prices can fluctuate, impacting the overall value of the investment.

- Dividend Cuts: Companies may reduce or eliminate dividends during financial difficulties.

- Interest Rate Changes: Rising interest rates can make dividend stocks less attractive compared to fixed-income investments.

Case Study: Successful Dividend Investments

By examining real-world examples of successful dividend investments, investors can gain valuable insights into effective strategies and best practices. Studying companies that have consistently delivered strong dividend performance can provide inspiration and guidance for building a profitable dividend portfolio.

Tips for Beginners Investing in Dividend Stocks

For those new to dividend investing, here are some helpful tips:

- Research Thoroughly: Conduct thorough research on potential dividend stocks and their financial performance.

- Focus on Quality: Prioritize companies with strong fundamentals and a history of reliable dividend payments.

- Monitor Regularly: Keep track of your investments and stay informed about company developments.

- Reinvest Dividends: Consider reinvesting dividends to compound returns over time.

How to Use 5starsstockscom to Optimize Investments?

5starsstockscom offers a range of tools and resources to help investors optimize their dividend investment strategy. By leveraging the platform's expert analysis, stock recommendations, and real-time data, investors can make informed decisions and enhance their portfolio's performance.

Frequently Asked Questions About Dividend Stocks

Here are some common questions about dividend stocks:

- What is the tax treatment of dividend income?

- How do dividends impact stock prices?

- Can dividends be reinvested automatically?

- What are the best dividend stocks for beginners?

Conclusion: Unlocking Potential with Dividend Stocks

Investing in dividend stocks can be a rewarding strategy for generating consistent income and building long-term wealth. By uncovering the top dividend stocks on 5starsstockscom, investors can access valuable insights and opportunities to enhance their investment portfolio. With careful research, diversification, and a focus on growth potential, dividend investors can unlock the full potential of their investments and achieve financial success.