The financial world is abuzz with speculation as investors and analysts eagerly anticipate Tesla's potential stock split in 2024. A stock split often signals a company's robust growth and makes shares more accessible to a broader range of investors. Tesla, known for its innovative strides in electric vehicles and renewable energy, has captured the attention of financial markets once again. The potential split could be a pivotal moment for both current and prospective investors, reflecting the company's ongoing commitment to growth and accessibility.

Tesla's history of stock splits has been met with significant interest and enthusiasm from the investing community. The company's most recent split in 2020 was seen as a strategic move to democratize share ownership and enhance its market liquidity. With the prospect of another split on the horizon, investors are keen to understand the potential implications for Tesla's stock price and market dynamics. This anticipated action is stirring discussions about Tesla's future trajectory and its impact on the broader market.

As the anticipation builds, many are pondering the strategic motives behind Tesla's potential stock split in 2024. A stock split could signify Tesla's confidence in its continued growth and its desire to maintain an attractive share price for a diverse investor base. Additionally, it could enhance trading volume and improve liquidity, making Tesla's stock more appealing to both retail and institutional investors. As we delve into the details, it becomes clear why the buzz surrounding Tesla's potential stock split is gaining momentum in the financial world.

Read also:Jennifer Hudsons Marital Status In 2024 An Insight Into Her Personal Life

Table of Contents

- Understanding Tesla's Stock Splits

- What is a Stock Split and How Does It Work?

- Historical Insights: Tesla's Previous Stock Splits

- Why is There Buzz Around the Anticipated Stock Split in 2024?

- What Could Be the Financial Impact of a Tesla Stock Split?

- How Do Investors View the Anticipated Tesla Stock Split?

- How Could a Stock Split Affect Tesla's Market Dynamics?

- Strategic Reasons Behind Tesla's Potential Decision

- Are Economic Conditions Favorable for a Stock Split?

- What Are the Potential Risks and Challenges?

- Tesla's Future Trajectory Post-Stock Split

- Expert Insights on Tesla's Anticipated Stock Split

- Investor Advice: Preparing for Tesla's Stock Split

- Conclusion: The Buzz and Its Implications

Understanding Tesla's Stock Splits

Tesla's approach to stock splits has been a strategic tool to ensure its shares remain accessible to a wide spectrum of investors. The company has demonstrated an ability to capture market attention and drive significant interest through its stock splits. Understanding Tesla's rationale and execution of these splits is crucial for investors keen on capitalizing on such opportunities. By exploring Tesla's past strategies, we gain insights into the potential benefits and outcomes of a future split.

What is a Stock Split and How Does It Work?

A stock split is a corporate action that increases the number of shares in a company while reducing the price of each individual share. It is a mechanism used by companies to enhance liquidity and make their stocks more appealing to investors. Stock splits do not affect a company's market capitalization or the value of individual investments; rather, they adjust the share price to a more accessible range. Investors often view stock splits as positive signals of a company's growth and market confidence.

For instance, in a 2-for-1 stock split, shareholders receive an additional share for each share they own, while the share price is halved. This action maintains the overall value of the investment but increases the number of shares, which can attract more investors and enhance market liquidity. Companies like Tesla utilize stock splits to broaden their shareholder base and increase trading activity.

Historical Insights: Tesla's Previous Stock Splits

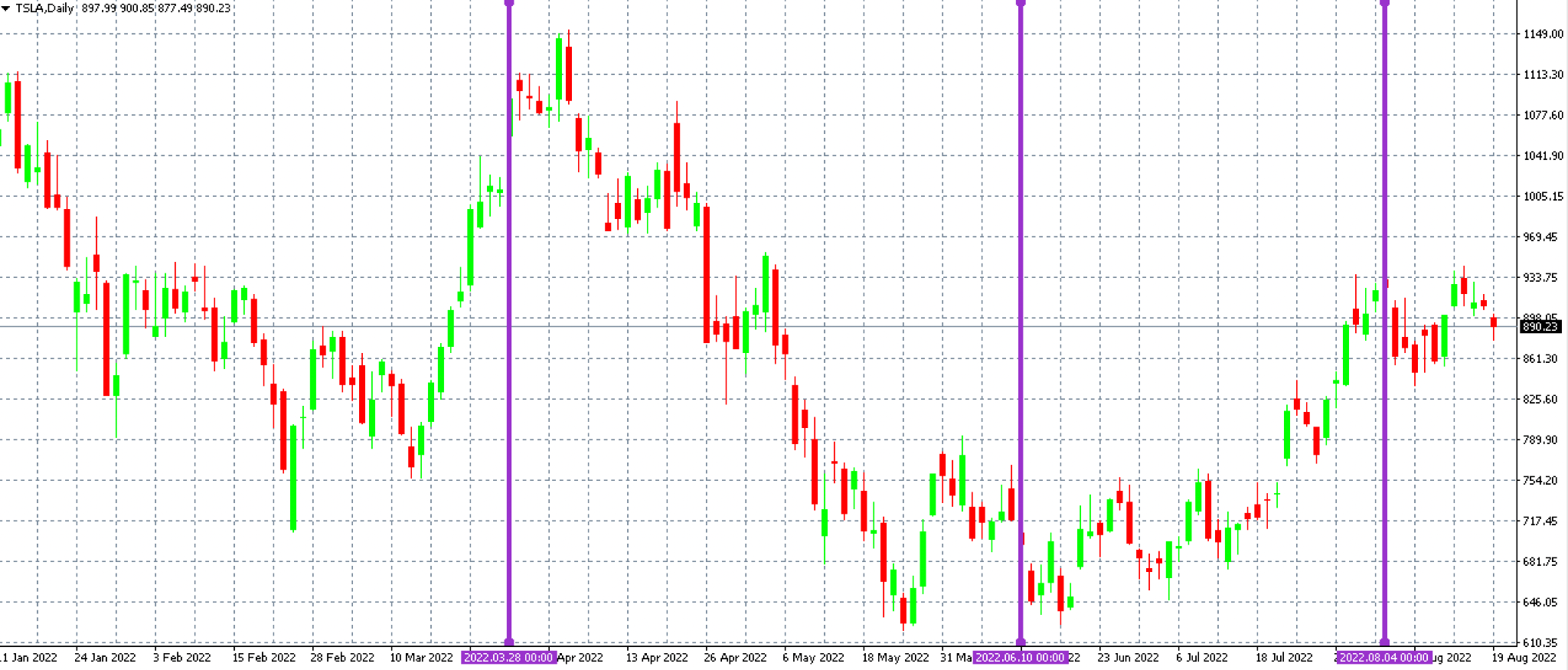

Tesla's history with stock splits provides valuable insights into the company's strategic decisions and market behavior. The company's last stock split occurred in 2020, when it executed a 5-for-1 split. This move was met with enthusiasm from investors and analysts, as it lowered Tesla's share price and attracted a broader range of investors. The split also resulted in increased trading volume and market capitalization, reflecting the positive sentiment surrounding Tesla's growth prospects.

Analyzing Tesla's previous stock splits allows us to understand the potential impacts of a future split. Investors can learn from past trends and market reactions to anticipate how a 2024 stock split might influence Tesla's share price and trading dynamics. By examining historical data, we can gain a clearer picture of Tesla's strategy and the potential benefits of another stock split.

Why is There Buzz Around the Anticipated Stock Split in 2024?

The buzz surrounding Tesla's anticipated stock split in 2024 stems from several factors that signal the company's growth and market potential. Investors and analysts are closely watching Tesla's performance, strategic decisions, and market trends to gauge the likelihood of a stock split. The anticipation is fueled by Tesla's strong financial results, expanding market presence, and continued innovations in the electric vehicle industry.

Read also:How Old Is Damon Salvatore The Ultimate Timeline Of The Vampire Diaries Character

Moreover, Tesla's stock has experienced significant price appreciation, making it a prime candidate for a stock split. As the company continues to achieve new milestones and expand its market reach, a stock split could serve as a strategic move to maintain investor interest and enhance market liquidity. The anticipation of a stock split in 2024 reflects the market's confidence in Tesla's future growth and success.

What Could Be the Financial Impact of a Tesla Stock Split?

A Tesla stock split in 2024 could have several financial implications for both the company and its investors. One of the primary benefits of a stock split is increased liquidity, as the lower share price makes the stock more accessible to a broader range of investors. This can lead to higher trading volumes and greater market participation, enhancing Tesla's overall market presence.

Additionally, a stock split can positively impact investor sentiment, as it is often perceived as a signal of a company's growth and confidence in its future prospects. This can lead to increased demand for Tesla's shares, driving the stock price higher and boosting market capitalization. For existing shareholders, a stock split can provide an opportunity to realize gains, as the increased demand and lower price point attract new investors.

How Do Investors View the Anticipated Tesla Stock Split?

Investors are closely monitoring the buzz around Tesla's anticipated stock split in 2024, as it presents both opportunities and challenges. On one hand, a stock split could make Tesla's shares more accessible to a wider range of investors, increasing demand and potentially boosting the stock price. On the other hand, some investors may be cautious about the potential risks and market volatility associated with stock splits.

Many investors view a stock split as a strategic move to enhance Tesla's market presence and attract new investors. The potential for increased liquidity and trading activity is seen as a positive outcome, as it can lead to higher stock valuations and greater market participation. However, investors are also mindful of the potential risks, such as market fluctuations and the impact on Tesla's overall financial performance.

How Could a Stock Split Affect Tesla's Market Dynamics?

A stock split can significantly impact Tesla's market dynamics by influencing investor behavior, trading volumes, and share price movements. By reducing the share price, a stock split makes Tesla's stock more accessible to retail investors, potentially increasing demand and trading activity. This can lead to greater market liquidity and enhanced market participation, benefiting both the company and its investors.

Furthermore, a stock split can affect investor sentiment and market perceptions of Tesla's growth trajectory. As a company that has consistently demonstrated innovation and market leadership, Tesla's stock split could be seen as a positive signal of its confidence in future growth. This can lead to increased investor interest and support, driving positive momentum in the stock market.

Strategic Reasons Behind Tesla's Potential Decision

Tesla's potential decision to execute a stock split in 2024 is likely driven by several strategic reasons aimed at enhancing its market position and shareholder value. One of the primary motivations for a stock split is to make Tesla's shares more accessible to a broader range of investors, thereby increasing demand and trading activity. This can lead to higher stock valuations and greater market participation, benefiting both the company and its shareholders.

Another strategic reason for a stock split is to enhance Tesla's market liquidity, making it easier for investors to buy and sell shares. This can lead to more efficient price discovery and reduced volatility, creating a more stable and attractive investment environment. Additionally, a stock split can signal Tesla's confidence in its future growth prospects, attracting new investors and reinforcing its market leadership.

Are Economic Conditions Favorable for a Stock Split?

The current economic conditions play a crucial role in determining the feasibility and timing of a stock split. For Tesla, favorable economic conditions can provide a supportive environment for executing a stock split and achieving its desired outcomes. Factors such as low interest rates, robust consumer demand, and strong market liquidity can create a conducive backdrop for a successful stock split.

Moreover, Tesla's strong financial performance and market position provide a solid foundation for executing a stock split. The company's continued growth and innovation in the electric vehicle industry position it well to capitalize on favorable economic conditions and achieve its strategic objectives. By carefully assessing the economic landscape, Tesla can make informed decisions about the timing and execution of a stock split in 2024.

What Are the Potential Risks and Challenges?

While a stock split offers several benefits, it also presents potential risks and challenges that Tesla must consider. One of the primary risks is market volatility, as changes in investor sentiment and market conditions can impact Tesla's stock price and trading dynamics. Additionally, a stock split may lead to increased scrutiny from investors and analysts, as they evaluate the company's growth prospects and financial performance.

Another potential challenge is managing investor expectations, as a stock split can create heightened anticipation and speculation about Tesla's future growth trajectory. To mitigate these risks, Tesla must effectively communicate its strategic objectives and provide transparency about its financial performance and market outlook. By addressing these challenges, Tesla can successfully navigate the complexities of a stock split and achieve its desired outcomes.

Tesla's Future Trajectory Post-Stock Split

The potential stock split in 2024 could have significant implications for Tesla's future trajectory and market position. By making its shares more accessible and enhancing market liquidity, Tesla can attract new investors and strengthen its market leadership. This can lead to increased demand for Tesla's stock and higher valuations, supporting the company's growth and innovation efforts.

Furthermore, a successful stock split can reinforce Tesla's reputation as a market leader and innovator in the electric vehicle industry. By demonstrating its commitment to shareholder value and market accessibility, Tesla can enhance its brand image and attract a broader investor base. As Tesla continues to achieve new milestones and expand its market presence, the stock split could be a pivotal moment in its growth journey.

Expert Insights on Tesla's Anticipated Stock Split

Financial analysts and industry experts are closely monitoring Tesla's anticipated stock split in 2024, offering valuable insights into the potential implications and outcomes. Many experts view the stock split as a strategic move to enhance Tesla's market presence and attract new investors. By making its shares more accessible and increasing trading activity, Tesla can achieve higher valuations and greater market participation.

Additionally, experts highlight the importance of effective communication and transparency in executing a successful stock split. By providing clear information about its strategic objectives and financial performance, Tesla can build investor confidence and support for its growth initiatives. As Tesla navigates the complexities of a stock split, expert insights can provide valuable guidance and support for achieving its desired outcomes.

Investor Advice: Preparing for Tesla's Stock Split

As the buzz around Tesla's anticipated stock split in 2024 grows, investors are seeking advice on how to prepare and capitalize on this potential opportunity. One key recommendation is to stay informed about Tesla's financial performance and strategic objectives, as these factors can influence the stock split's timing and execution. By closely monitoring market trends and company updates, investors can make informed decisions about their investment strategies.

Another piece of advice is to evaluate the potential risks and benefits of a stock split, considering factors such as market volatility and investor sentiment. By assessing these variables, investors can develop strategies to mitigate risks and capitalize on potential opportunities. Additionally, investors may consider diversifying their portfolios to manage risk and enhance their overall investment performance.

Conclusion: The Buzz and Its Implications

The buzz surrounding Tesla's anticipated stock split in 2024 reflects the company's strong market presence and growth potential. As investors and analysts eagerly await the potential split, Tesla's strategic objectives and financial performance will play a crucial role in determining its success. By effectively communicating its vision and navigating the complexities of a stock split, Tesla can achieve its desired outcomes and reinforce its position as a market leader.

As we continue to monitor Tesla's progress and market dynamics, the anticipated stock split offers a unique opportunity for investors to capitalize on the company's growth and innovation efforts. By staying informed and evaluating the potential risks and benefits, investors can make informed decisions and position themselves for success in the evolving market landscape.