When it comes to investing in the stock market, one of the most important decisions you'll make is choosing the right exchange-traded fund (ETF). Two of the most popular ETFs are VTI and VOO. But which one is right for you?

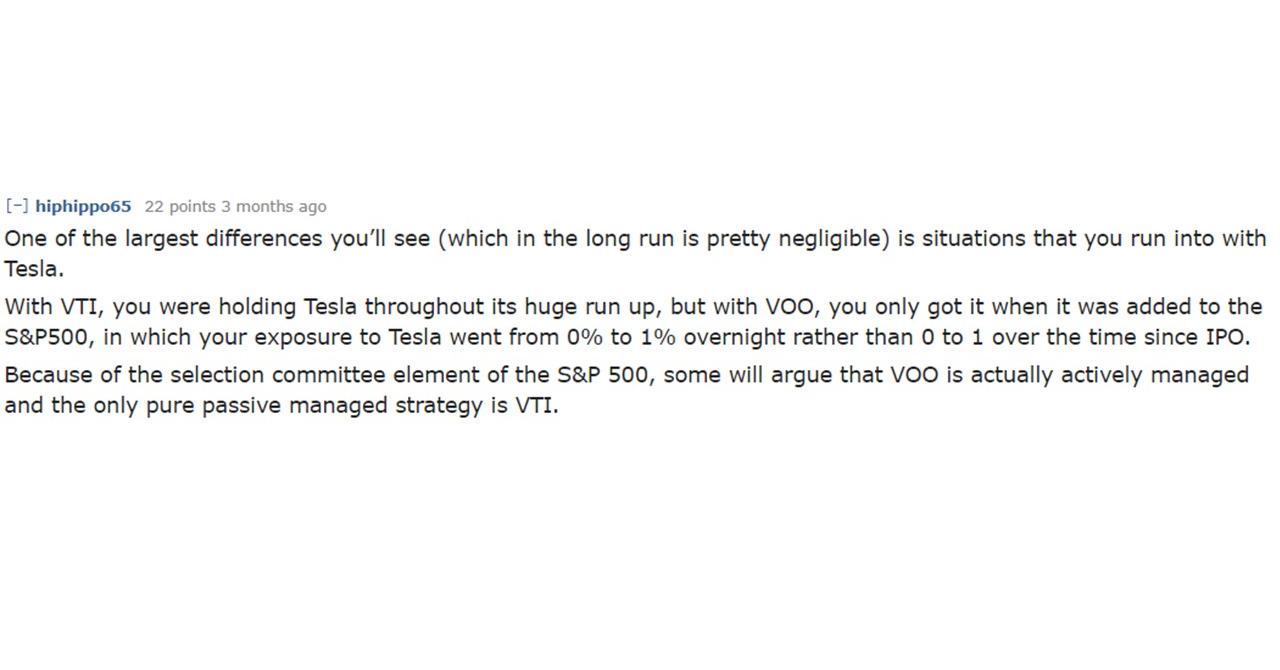

VTI is a total stock market ETF, which means it tracks the entire U.S. stock market. VOO, on the other hand, is an S&P 500 ETF, which means it tracks the 500 largest companies in the U.S. stock market.

So, which one should you choose? It really depends on your investment goals. If you're looking for a broad exposure to the U.S. stock market, then VTI is a good option. If you're looking for a more focused exposure to the largest companies in the U.S. stock market, then VOO is a good option.

Read also:Maynard Keenans Wealth A Rock Legends Financial Overview

Ultimately, the best way to decide which ETF is right for you is to talk to a financial advisor. They can help you assess your investment goals and risk tolerance and recommend the ETF that's right for you.

VTI vs VOO

When it comes to investing in the stock market, one of the most important decisions you'll make is choosing the right exchange-traded fund (ETF). Two of the most popular ETFs are VTI and VOO. But which one is right for you?

- Total market vs. S&P 500: VTI is a total stock market ETF, which means it tracks the entire U.S. stock market. VOO, on the other hand, is an S&P 500 ETF, which means it tracks the 500 largest companies in the U.S. stock market.

- Diversification: VTI is more diversified than VOO, as it holds a greater number of stocks. This makes VTI a less risky investment than VOO.

- Returns: VTI has historically outperformed VOO, but VOO has a lower expense ratio.

- Fees: VTI has a lower expense ratio than VOO.

- Investment goals: VTI is a good option for investors who are looking for a broad exposure to the U.S. stock market. VOO is a good option for investors who are looking for a more focused exposure to the largest companies in the U.S. stock market.

- Risk tolerance: VTI is a less risky investment than VOO, as it is more diversified.

- Time horizon: VTI is a good option for investors who have a long time horizon, as it has historically outperformed VOO.

Ultimately, the best way to decide which ETF is right for you is to talk to a financial advisor. They can help you assess your investment goals and risk tolerance and recommend the ETF that's right for you.

1. Total market vs. S&P 500

When it comes to investing in the stock market, one of the most important decisions you'll make is choosing the right exchange-traded fund (ETF). Two of the most popular ETFs are VTI and VOO. But which one is right for you?

- Diversification: VTI is more diversified than VOO, as it holds a greater number of stocks. This makes VTI a less risky investment than VOO.

- Returns: VTI has historically outperformed VOO, but VOO has a lower expense ratio.

- Investment goals: VTI is a good option for investors who are looking for a broad exposure to the U.S. stock market. VOO is a good option for investors who are looking for a more focused exposure to the largest companies in the U.S. stock market.

- Risk tolerance: VTI is a less risky investment than VOO, as it is more diversified.

Ultimately, the best way to decide which ETF is right for you is to talk to a financial advisor. They can help you assess your investment goals and risk tolerance and recommend the ETF that's right for you.

2. Diversification

When it comes to investing in the stock market, diversification is key. Diversification means investing in a variety of assets, such as stocks, bonds, and real estate. This helps to reduce your risk of losing money if one asset class performs poorly.

Read also:Meet Steve Perryrsquos Wife The Woman Behind The Icon

- Reduced risk: VTI is more diversified than VOO, which means it is a less risky investment. This is because VTI holds a greater number of stocks, which helps to reduce the impact of any one stock's performance on the overall portfolio.

- Improved returns: Over the long term, diversification has been shown to improve returns. This is because diversified portfolios are less likely to experience large losses, which can eat into your returns over time.

- Peace of mind: Investing in a diversified portfolio can give you peace of mind, knowing that you are not putting all of your eggs in one basket.

If you are looking for a less risky investment, VTI is a good option. It is a diversified portfolio that has historically outperformed VOO, which is a less diversified portfolio.

3. Returns

When comparing VTI and VOO, it's important to consider both returns and expenses. VTI has historically outperformed VOO, but VOO has a lower expense ratio. This means that VTI has generated higher returns for investors over time, but VOO has lower ongoing costs.

- Historical returns: VTI has outperformed VOO over the long term. This is because VTI tracks the entire U.S. stock market, which has historically outperformed the S&P 500.

- Expense ratio: VOO has a lower expense ratio than VTI. This means that VOO has lower ongoing costs, which can eat into returns over time.

- Investment goals: If you are looking for an ETF with a long track record of outperformance, VTI is a good option. However, if you are looking for an ETF with a low expense ratio, VOO is a good option.

Ultimately, the best way to decide which ETF is right for you is to talk to a financial advisor. They can help you assess your investment goals and risk tolerance and recommend the ETF that's right for you.

4. Fees

When comparing VTI and VOO, it's important to consider both returns and expenses. VTI has historically outperformed VOO, but VOO has a lower expense ratio. This means that VTI has generated higher returns for investors over time, but VOO has lower ongoing costs.

The expense ratio is a key factor to consider when choosing an ETF. It is a percentage of assets that is charged annually to cover the fund's operating expenses. A lower expense ratio means that more of your money is invested in the fund and less is going to cover the fund's expenses. This can make a big difference over time.

For example, let's say you invest $10,000 in VTI and $10,000 in VOO. VTI has an expense ratio of 0.03%, while VOO has an expense ratio of 0.04%. Over 10 years, the expense ratio would cost you $30 in VTI and $40 in VOO. This may not seem like a lot, but it can add up over time.

If you are looking for an ETF with a low expense ratio, VTI is a good option. It has a lower expense ratio than VOO, which means that more of your money is invested in the fund and less is going to cover the fund's expenses.

5. Investment goals

When it comes to investing in the stock market, one of the most important decisions you'll make is choosing the right exchange-traded fund (ETF). Two of the most popular ETFs are VTI and VOO. But which one is right for you?

- Investment goals: Your investment goals should be the primary factor in your decision-making process. If you're looking for a broad exposure to the U.S. stock market, VTI is a good option. If you're looking for a more focused exposure to the largest companies in the U.S. stock market, VOO is a good option.

- Diversification: VTI is more diversified than VOO, as it holds a greater number of stocks. This makes VTI a less risky investment than VOO.

- Returns: VTI has historically outperformed VOO, but VOO has a lower expense ratio.

- Fees: VTI has a lower expense ratio than VOO.

Ultimately, the best way to decide which ETF is right for you is to talk to a financial advisor. They can help you assess your investment goals and risk tolerance and recommend the ETF that's right for you.

6. Risk tolerance

When it comes to investing, one of the most important things to consider is your risk tolerance. Risk tolerance is a measure of how much risk you are comfortable taking with your investments. Some investors are more aggressive and are willing to take on more risk in order to potentially earn higher returns. Other investors are more conservative and prefer to invest in less risky assets, even if it means earning lower returns.

If you are a conservative investor, VTI is a good option for you. VTI is a diversified ETF that tracks the entire U.S. stock market. This means that it invests in a wide range of stocks, from large-cap to small-cap. This diversification helps to reduce the risk of your investment losing value.

VOO, on the other hand, is a less diversified ETF. It tracks the S&P 500 index, which is made up of the 500 largest companies in the U.S. This means that VOO is more concentrated in large-cap stocks. As a result, VOO is a riskier investment than VTI.

Ultimately, the best way to decide which ETF is right for you is to talk to a financial advisor. They can help you assess your investment goals and risk tolerance and recommend the ETF that's right for you.

7. Time horizon

When considering "vti vs voo which etf is right for you", it is important to consider your time horizon. Time horizon refers to the amount of time you plan to invest. If you have a long time horizon, you may be willing to take on more risk in order to potentially earn higher returns. If you have a short time horizon, you may want to invest in less risky assets, even if it means earning lower returns.

VTI is a good option for investors who have a long time horizon. This is because VTI has historically outperformed VOO. For example, over the past 10 years, VTI has returned an average of 10% per year, while VOO has returned an average of 9% per year. This may not seem like a big difference, but it can add up over time.

Of course, past performance is not a guarantee of future results. However, if you are confident that the U.S. stock market will continue to grow over the long term, then VTI is a good option for you.

FAQs on "VTI vs VOO

This section addresses frequently asked questions and misconceptions surrounding VTI and VOO ETFs, providing concise and informative answers.

Question 1: What is the key difference between VTI and VOO?

VTI is a total stock market ETF that tracks the entire U.S. stock market, while VOO is an S&P 500 ETF that tracks the 500 largest companies in the U.S. stock market.

Question 2: Which ETF is more diversified?

VTI is more diversified than VOO, as it holds a greater number of stocks. This diversification helps to reduce the risk of your investment losing value.

Question 3: Which ETF has historically performed better?

VTI has historically outperformed VOO, but VOO has a lower expense ratio. This means that VTI has generated higher returns for investors over time, but VOO has lower ongoing costs.

Question 4: Which ETF is right for me?

The best ETF for you depends on your investment goals and risk tolerance. VTI is a good option for investors who are looking for a broad exposure to the U.S. stock market and have a long time horizon. VOO is a good option for investors who are looking for a more focused exposure to the largest companies in the U.S. stock market and are willing to take on more risk.

Question 5: Should I invest in both VTI and VOO?

Investing in both VTI and VOO can provide further diversification to your portfolio. However, it is important to consider your investment goals and risk tolerance before making this decision.

Summary: VTI and VOO are both solid ETFs that can provide investors with exposure to the U.S. stock market. VTI is more diversified and has historically outperformed VOO, but VOO has a lower expense ratio. Ultimately, the best ETF for you depends on your individual investment goals and risk tolerance.

Next Article Section: Key Takeaways and Conclusion

Conclusion

When it comes to choosing between VTI and VOO, there is no one-size-fits-all answer. The best ETF for you depends on your investment goals, risk tolerance, and time horizon. If you are looking for a broad exposure to the U.S. stock market and have a long time horizon, VTI is a good option. If you are looking for a more focused exposure to the largest companies in the U.S. stock market and are willing to take on more risk, VOO is a good option.

Ultimately, the decision of which ETF to invest in is a personal one. It is important to do your research and understand the risks involved before making a decision.