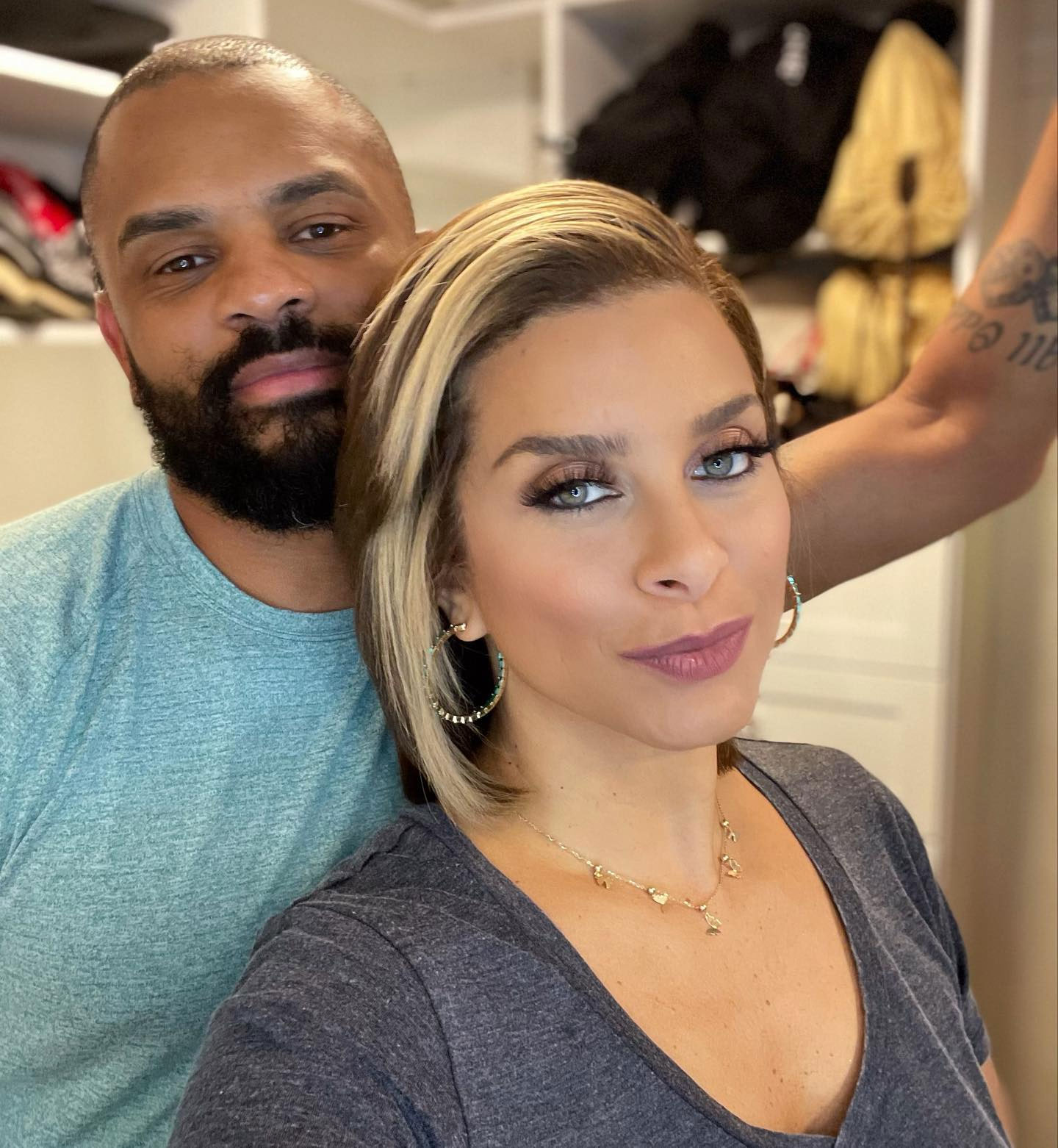

Delving into the Fortune of Juan and Robyn Dixon

Understanding the fortune of Juan and Robyn Dixon involves examining key aspects that encompass their financial journey and wealth accumulation strategies. These aspects delve into various dimensions of their success, providing valuable insights for aspiring wealth builders.

- Assets: Exploring the types and value of assets owned by Juan and Robyn Dixon.

- Investments: Analyzing their investment strategies, including stocks, real estate, and other ventures.

- Income: Examining their sources of income, such as salaries, dividends, and business profits.

- Financial Management: Evaluating their financial planning and management practices, including budgeting, saving, and debt management.

- Entrepreneurship: Exploring Robyn Dixon's entrepreneurial ventures and their contribution to the couple's wealth.

- Philanthropy: Examining their charitable contributions and social impact initiatives.

These key aspects provide a comprehensive understanding of Juan and Robyn Dixon's fortune. By delving into their financial strategies, investment decisions, and entrepreneurial endeavors, we gain valuable insights into wealth creation and management. Their journey serves as an inspiration for aspiring wealth builders, demonstrating the power of financial literacy, calculated risk-taking, and a commitment to building a lasting legacy.

1. Assets

Understanding the types and value of assets owned by Juan and Robyn Dixon is a crucial aspect of delving into their fortune. Assets represent the resources and properties that contribute to their overall wealth. By examining their asset portfolio, we gain insights into their investment strategies, financial planning, and risk management approaches.

Read also:Jon Cryer And Charlie Sheen A Tale Of Friendship And Fame

- Real Estate

Juan and Robyn Dixon have invested heavily in real estate, owning multiple properties in Maryland and Virginia. Their real estate portfolio includes residential homes, rental properties, and commercial buildings. This asset class provides them with a stable source of income through rent and potential capital appreciation over time.

- Stocks and Bonds

The couple has also diversified their investments into stocks and bonds. They hold a portfolio of publicly traded companies, including blue-chip stocks and growth stocks. Their stock investments provide them with the potential for capital gains and dividends, while bonds offer a steadier stream of income.

- Private Equity and Venture Capital

Juan and Robyn Dixon have made strategic investments in private equity and venture capital funds. These investments provide them with exposure to high-growth companies and the potential for significant returns. However, these investments also carry a higher level of risk.

- Intellectual Property

Robyn Dixon's entrepreneurial ventures have generated valuable intellectual property, including trademarks, copyrights, and patents. These assets contribute to the couple's wealth and provide them with ongoing revenue streams.

By examining the types and value of assets owned by Juan and Robyn Dixon, we gain a comprehensive understanding of their wealth accumulation strategies. Their diversified portfolio, prudent investment decisions, and entrepreneurial ventures have contributed significantly to their financial success.

2. Investments

Investments are a crucial component of delving into the fortune of Juan and Robyn Dixon. Their investment strategies have played a significant role in growing their wealth and securing their financial future. By analyzing their investment portfolio, we can gain valuable insights into their risk tolerance, financial goals, and overall investment philosophy.

Read also:The Remarkable Life And Legacy Of Dorothy Jeter An Inspiring Narrative

Juan and Robyn Dixon have diversified their investments across various asset classes, including stocks, real estate, and private equity. This diversification helps to reduce risk and enhance the overall return on their investments. Their stock investments provide them with exposure to the growth potential of the stock market, while their real estate investments offer a stable source of income and potential capital appreciation.

One notable aspect of their investment strategy is their focus on long-term growth. They have invested in companies with strong fundamentals and a track record of consistent performance. They are also patient investors, willing to hold onto their investments for extended periods to maximize returns.

Furthermore, Juan and Robyn Dixon have demonstrated a willingness to take calculated risks. They have invested in emerging markets and high-growth industries, which have the potential for significant returns but also carry a higher level of risk.

By analyzing the investment strategies of Juan and Robyn Dixon, we gain a deeper understanding of their financial acumen and wealth accumulation strategies. Their diversified portfolio, long-term investment horizon, and calculated risk-taking have contributed significantly to their overall fortune.

3. Income

Income plays a vital role in delving into the fortune of Juan and Robyn Dixon. It represents the sources of cash flow that contribute to their wealth accumulation and financial stability.

- Salaries

Juan Dixon earned a substantial salary during his NBA career. Robyn Dixon receives income from her reality TV appearances and business ventures.

- Dividends

The couple receives dividends from their stock investments. Dividends represent a portion of a company's profits that are distributed to shareholders.

- Business Profits

Robyn Dixon's entrepreneurial ventures generate business profits. These profits contribute to the couple's overall income and wealth.

Examining the income sources of Juan and Robyn Dixon provides insights into their financial management and wealth-building strategies. Their diverse income streams contribute to their financial resilience and long-term wealth accumulation goals.

4. Financial Management

Financial management is a crucial aspect of delving into the fortune of Juan and Robyn Dixon. It encompasses the strategies and practices they employ to plan, manage, and grow their wealth. By examining their financial management approach, we gain insights into their financial discipline, risk tolerance, and long-term financial goals.

- Budgeting

Budgeting is the foundation of sound financial management. Juan and Robyn Dixon likely have a well-defined budget that outlines their income and expenses. Sticking to a budget helps them control their spending, prioritize their financial goals, and avoid unnecessary debt.

- Saving

Saving is essential for building wealth and achieving financial security. Juan and Robyn Dixon are likely committed to saving a significant portion of their income. They may have various savings accounts for different financial goals, such as retirement, their children's education, or a down payment on a new home.

- Debt Management

Debt management is crucial for maintaining financial stability. Juan and Robyn Dixon likely have a disciplined approach to managing debt. They may prioritize paying off high-interest debts first and avoid taking on unnecessary debt. By managing debt effectively, they can reduce interest payments and improve their overall financial health.

- Investment Strategy

Investment strategy is closely linked to financial management. Juan and Robyn Dixon's investment decisions are likely aligned with their financial goals, risk tolerance, and time horizon. They may have a diversified portfolio that includes stocks, bonds, real estate, and other investments.

Overall, Juan and Robyn Dixon's financial management practices contribute significantly to their wealth and financial well-being. Their disciplined approach to budgeting, saving, debt management, and investing has enabled them to accumulate and preserve their fortune.

5. Entrepreneurship

Robyn Dixon's entrepreneurial endeavors have been a significant contributor to the couple's overall wealth. Her ventures have not only provided additional income streams but also enhanced their financial resilience and long-term financial goals.

- Event Planning and Management

Robyn Dixon founded her own event planning and management company, Embellished Events by Robyn. The company specializes in planning and executing high-end events, including weddings, corporate functions, and private parties. Robyn's expertise in event planning and her ability to create memorable experiences have made her company a sought-after choice for clients. The profits generated from her event planning business have contributed to the couple's wealth and financial stability.

- Reality Television

Robyn Dixon's participation in the reality television series "The Real Housewives of Potomac" has also contributed to her financial success. As a cast member, she receives a salary for her participation in the show. Additionally, her increased public visibility has led to lucrative endorsement deals and other business opportunities.

- Fashion and Lifestyle Brand

Robyn Dixon has leveraged her fashion sense and entrepreneurial spirit to launch her own clothing and lifestyle brand, Robyn Dixon Collection. The brand offers a range of stylish and affordable clothing, accessories, and home goods. Robyn's ability to connect with her audience and understand their fashion needs has resulted in strong sales and a growing customer base. The profits from her fashion brand have further contributed to the couple's wealth.

- Philanthropy and Social Impact

Robyn Dixon's entrepreneurial ventures extend beyond financial gain. She is actively involved in various philanthropic initiatives and uses her platform to raise awareness for important social causes. Her philanthropic efforts have not only made a positive impact on her community but have also enhanced her reputation and brand value.

In conclusion, Robyn Dixon's entrepreneurial endeavors have played a vital role in delving into the fortune of Juan and Robyn Dixon. Her diverse business ventures, coupled with her strategic investments and financial management, have significantly contributed to the couple's overall wealth and financial well-being.

6. Philanthropy

Exploring philanthropy is an important aspect of delving into the fortune of Juan and Robyn Dixon. Their charitable contributions and social impact initiatives provide insights into their values, priorities, and commitment to giving back to their community and beyond.

- Community Involvement

The Dixons are actively involved in their local community, supporting various organizations and initiatives. They have donated to schools, soup kitchens, and homeless shelters, demonstrating their commitment to social welfare and improving the lives of those in need.

- Health and Education

The couple recognizes the importance of health and education in building a better future. They have made significant contributions to organizations focused on health research, disease prevention, and educational opportunities for underprivileged youth.

- Arts and Culture

The Dixons appreciate the transformative power of arts and culture. They have supported museums, theaters, and arts education programs, believing that access to artistic experiences enriches lives and fosters creativity.

- International Impact

The couple's philanthropic reach extends beyond their local community. They have supported organizations working to address global challenges such as poverty, hunger, and environmental sustainability.

Through their charitable contributions and social impact initiatives, Juan and Robyn Dixon demonstrate their commitment to using their wealth and influence to make a positive difference in the world. Their philanthropy aligns with their values and reflects their desire to create a lasting legacy that extends beyond financial success.

Frequently Asked Questions

This section addresses common questions and misconceptions surrounding the fortune of Juan and Robyn Dixon.

Question 1: How did Juan and Robyn Dixon accumulate their wealth?

Answer: The couple's wealth stems from Juan's successful NBA career, Robyn's entrepreneurial ventures, including event planning and her clothing line, savvy investments, and their combined income from salaries, dividends, and business profits.

Question 2: What is the key to their financial success?

Answer: Juan and Robyn Dixon attribute their financial success to their disciplined approach to budgeting, saving, and debt management. They prioritize long-term investments, diversify their portfolio, and make calculated financial decisions.

Question 3: How do they manage their wealth?

Answer: The couple employs a team of financial advisors who assist with investment management, tax planning, and estate planning. They regularly review their financial goals and make adjustments as needed to ensure their wealth continues to grow and support their lifestyle.

Question 4: What are their philanthropic interests?

Answer: Juan and Robyn Dixon are passionate about giving back to their community and beyond. They support organizations focused on health, education, arts and culture, and international development.

Question 5: What lessons can be learned from their financial journey?

Answer: The couple's financial journey offers several valuable lessons, including the importance of financial literacy, prudent investment, calculated risk-taking, and the power of compounding wealth over time.

Understanding these aspects provides a comprehensive insight into the fortune of Juan and Robyn Dixon. Their wealth is a testament to their hard work, financial acumen, and commitment to building a lasting legacy.

Transition to the next article section...

Conclusion

Exploring the fortune of Juan and Robyn Dixon provides valuable insights into wealth creation, strategic investment, and the power of financial discipline. Their journey serves as a reminder that financial success is attainable through hard work, calculated risk-taking, and a commitment to long-term planning.

The Dixons' diversified portfolio, entrepreneurial ventures, and philanthropic initiatives highlight the importance of building a well-rounded financial foundation. Their wealth extends beyond monetary value, impacting their community and leaving a lasting legacy. By examining their financial strategies and values, we gain valuable lessons that can guide our own financial journeys.